A new wave of COVID-19 cases threatens to trip up the economy. Increasing cases in Europe and the United States have brought new restrictions on activities, but the market doesn’t appear to be fazed by the recent outbreaks. Progress on developing vaccines has provided a clear boost to sentiment, but prospects for a divided Congress and the potential for more fiscal policy support also may be playing a role.

NEW WAVE OF COVID-19

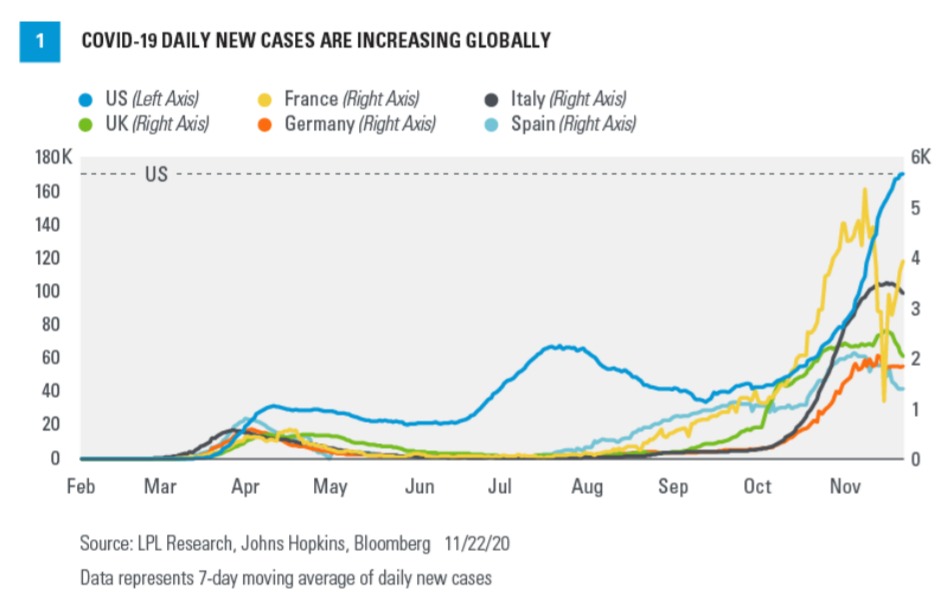

Just as the economic recovery was beginning to gain some steam, COVID-19 cases have been rising dramatically in several regions around the world [FIGURE 1]. The change of seasons is adding to concerns, as colder weather shifts more activities indoors—increasing the chances of viral transmissions. This has prompted many governments to take greater action to try to curb the spread of COVID-19. Several countries and many states in the United States have rolled back reopening plans and implemented new restrictions such as school closures, nighttime curfews, and even stay-at-home orders.

ECONOMIC EFFECTS OF LOCKDOWN 2.0

The new round of restrictions, dubbed “lockdown 2.0,” has already begun to cause a decline in economic activity in the Eurozone. Markit’s composite Purchasing Managers Index (PMI) for the Eurozone, a survey of purchasing managers’ spending plans released November 23, slipped back into contractionary (sub-50) territory at 45.1, dragged down by the services component. Manufacturing activity remained expansionary at 53.6—highlighting the outsized effects that the COVID-19 outbreak has had on service industries.

While the United States has not implemented the same degree of restrictions as Europe, rising cases already have had an effect on consumer and business behavior. Restaurant-booking data from OpenTable has declined since mid-October, and weekly jobless claims have begun to tick higher—which will be key for consumer spending going forward. If cases continue to rise, we likely will see greater action by local governments to limit high-risk activities, which may further threaten the economic recovery.

Meanwhile, we’ve received positive news on progress toward a vaccine in recent weeks as well as insight into the potential efficacy of the vaccine candidates. This will be key to propping up consumer confidence in the near term. However, the timeline for the actual rollout of the vaccine may take longer than many expect, even with the Food and Drug Administration’s Emergency Use Authorization expediting approval and distribution.

WHAT’S NEXT FOR STOCKS?

With the end of the year rapidly approaching and stocks having exceeded our 2020 year-end fair value target of 3,450–3,500 for the S&P 500 Index, we are focusing on 2021. At this point, we believe the pandemic will recede over the course of 2021, which increases our confidence in a robust earnings recovery. Other factors supporting the potential for solid gains for stocks next year include a likely market-friendly split Congress (Democrats controlling the US House and Republicans in the majority in the Senate), prospects for additional fiscal stimulus over the next several months, and low interest rates. Look for our 2021 year-end S&P 500 target in our Outlook 2021: Powering Forward publication on December 8.

For 2021 we maintain our equity overweight recommendation that we first put in place in March 2020. Although the latest wave of COVID-19 and lingering political uncertainty present risks to markets, we believe stocks are in the early stages of a new bull market, supported by a durable economic expansion. We maintain our slight preference for growth-style stocks over value style, but as the pandemic subsides and the economic outlook improves, cyclical value stocks may be poised for sustained outperformance. We would expect this environment to also be favorable for small cap stocks.

LPL RESEARCH’S BOTTOM LINE

Stocks may not appear fazed by the recent spike in COVID-19 cases in part because of expectations for more stimulus and prospects for vaccine distribution starting as soon as December. However, underlying economic data has begun to reflect the effects of efforts by governments and individuals to curb the spread of the virus. As we enter a challenging season, the battle against the virus continues.

Everyone please stay safe and be well. Best wishes for an enjoyable holiday season!

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Midyear Outlook 2020: The Trail to Recovery publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value with respect to such entity.

Tracking # 1-05083796 (Exp. 11/21)